Hudson Avenue Advises Trinity Hunt’s Platform Investment, NexCore, on the Acquisitions of Sylvester & Cockrum, Kennedy Mechanical Contractors and Ryan Plumbing & Heating

TRANSACTION SUMMARY

- Growth-oriented Sponsor executing on a thematic buy-and-build strategy via the acquisition of 3 accretive targets on top of a robust M&A pipeline

- Aggressive value creation plan centered around building a differentiated maintenance-first commercial facility services platform with a national footprint

- Model centered around maintenance, repair and replacement services driving highly reoccurring revenue with opportunity for wallet share expansion via footprint growth

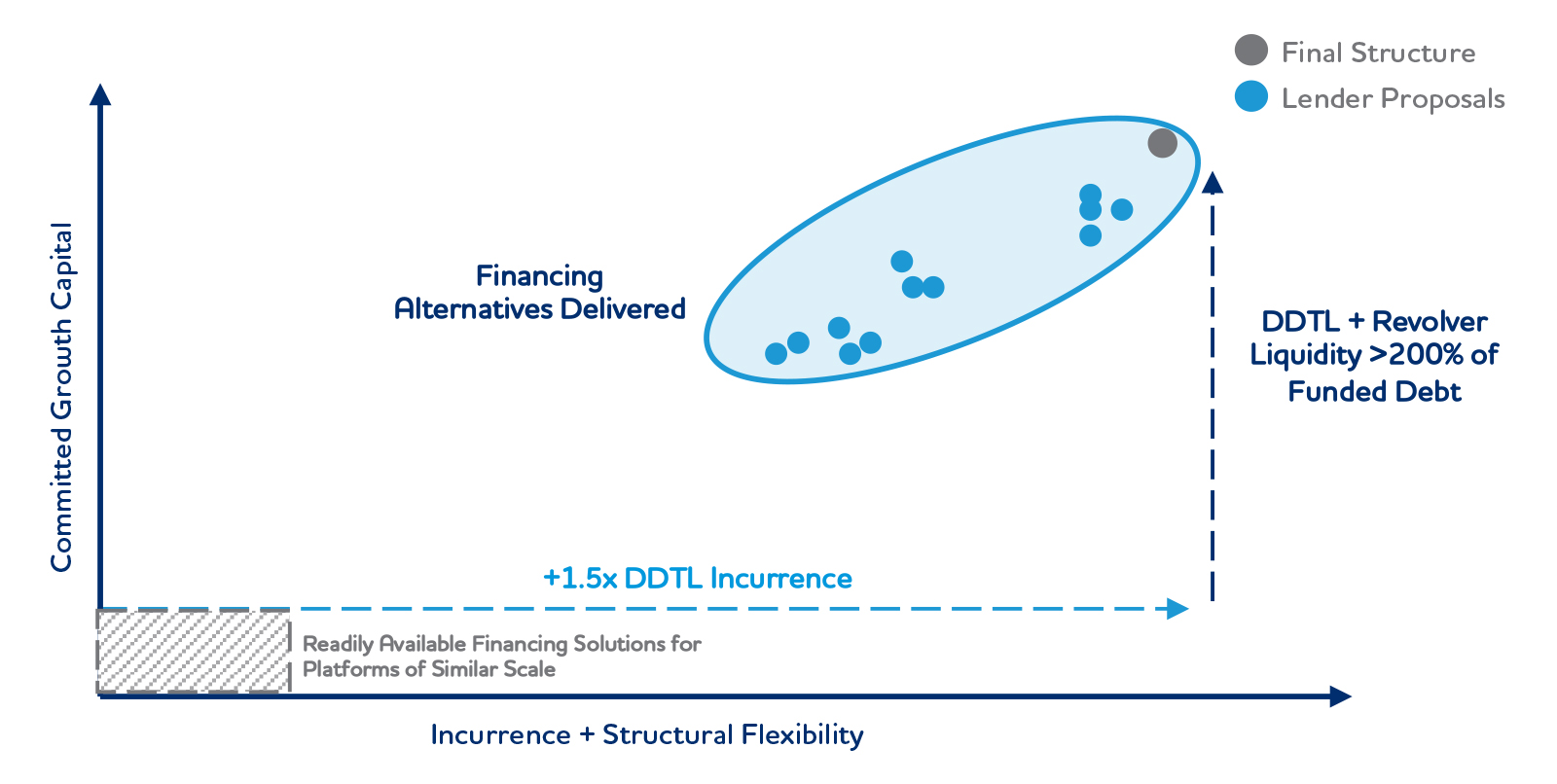

- Financing required from lender comfortable with high-growth platform and conviction in value creation plan via outsized DDTL support

OUTLIER PROCESS RESULTS

© Hudson Avenue Partners LLC, All Rights Reserved.