Hudson Avenue Advises Bluewater and Pipeline Technique on its Triple Acquisition from Stanley Black & Decker

TRANSACTION SUMMARY

- UK-based Sponsor and Company executing series of US-based carve-outs, each with distinct cross-border financing needs

- Complex integration strategy designed to reduce operating costs and propel organization into energy transition markets

- Intricate legal structure given number of global entities acquired and jurisdiction-specific tax requirements

- Financing required from lender comfortable with global nature of borrower entities, operations and cash flows

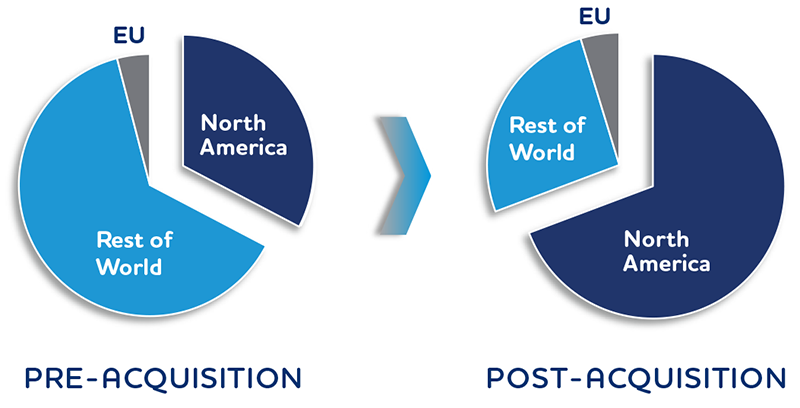

EVOLVING GLOBAL REVENUE BASE

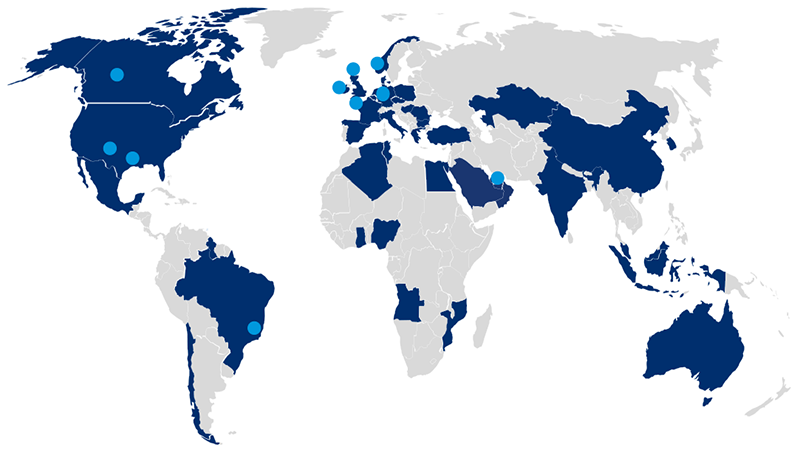

OPERATIONS IN 100+ COUNTRIES

© Hudson Avenue Partners LLC, All Rights Reserved.