Hudson Avenue Advises Trinity Hunt on Financing to Support Acquisition of Supreme Optimization

TRANSACTION SUMMARY

- Growth-oriented Sponsor executing thematic buy-and-build for “first-to-market” platform operating in a niche digital marketing segment

- Aggressive value creation plan designed to rapidly scale service offerings and client roster via actionable add-on acquisition targets

- Global organizational reach and operating model with tangible near term expansion opportunities

- Financing required from lender comfortable with “sub-scale” platform and conviction to support expedited add-on growth via DDTL

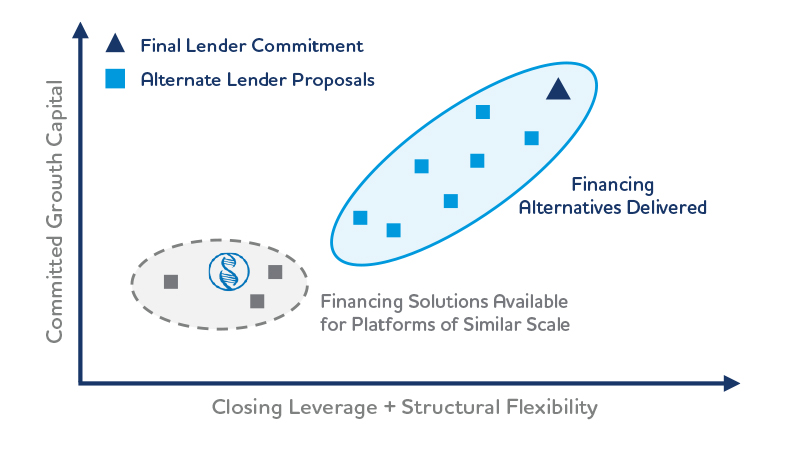

OUTLIER FINANCING OUTCOME

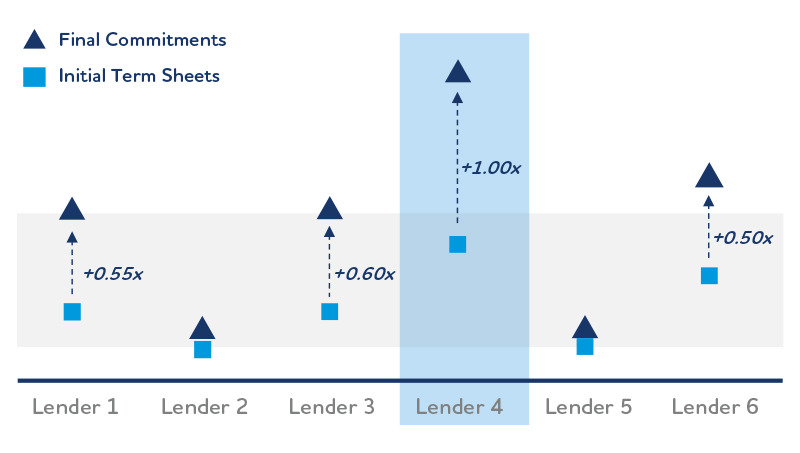

CONVICTION ACROSS STRUCTURAL OPTIONS

© Hudson Avenue Partners LLC, All Rights Reserved.